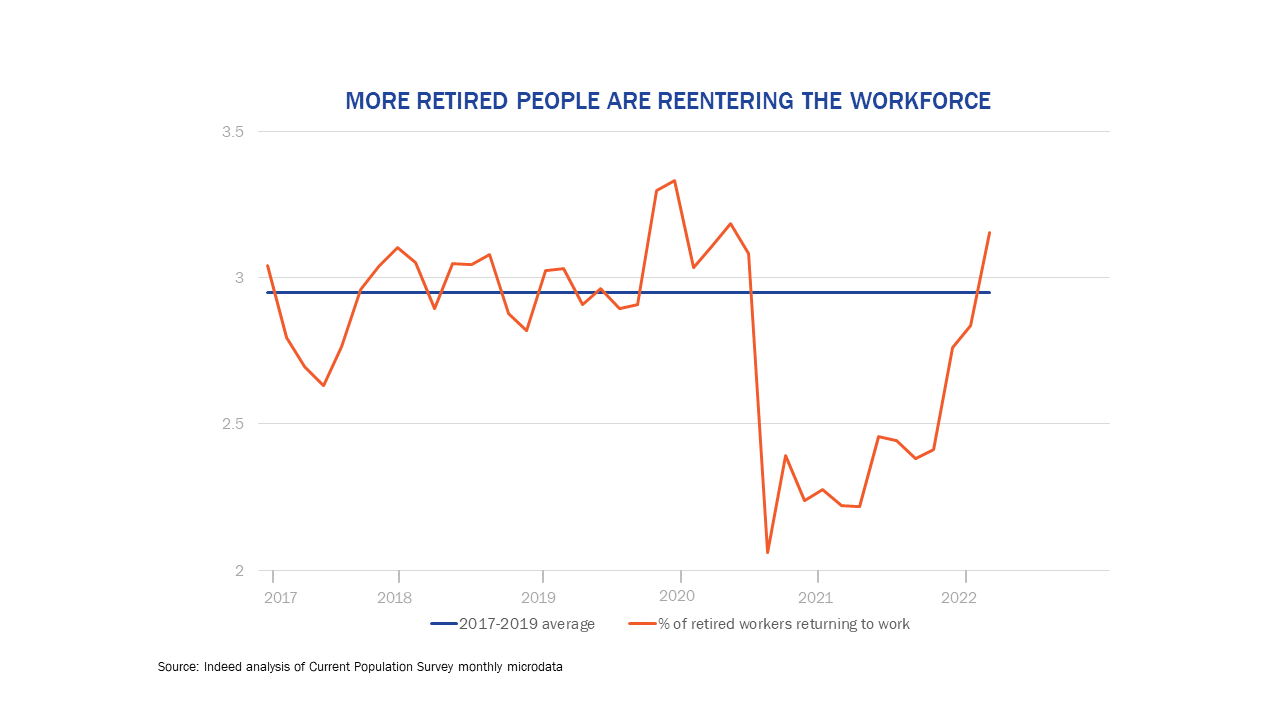

According to the U.S. Bureau of Labor Statistics, more retirees are returning to the workplace. Do we know why? Some of the possibilities are the rise in inflation, stock market volatility, a need for health insurance if you retired early during COVID-19, the changing work landscape seeing more jobs be available, and loneliness.

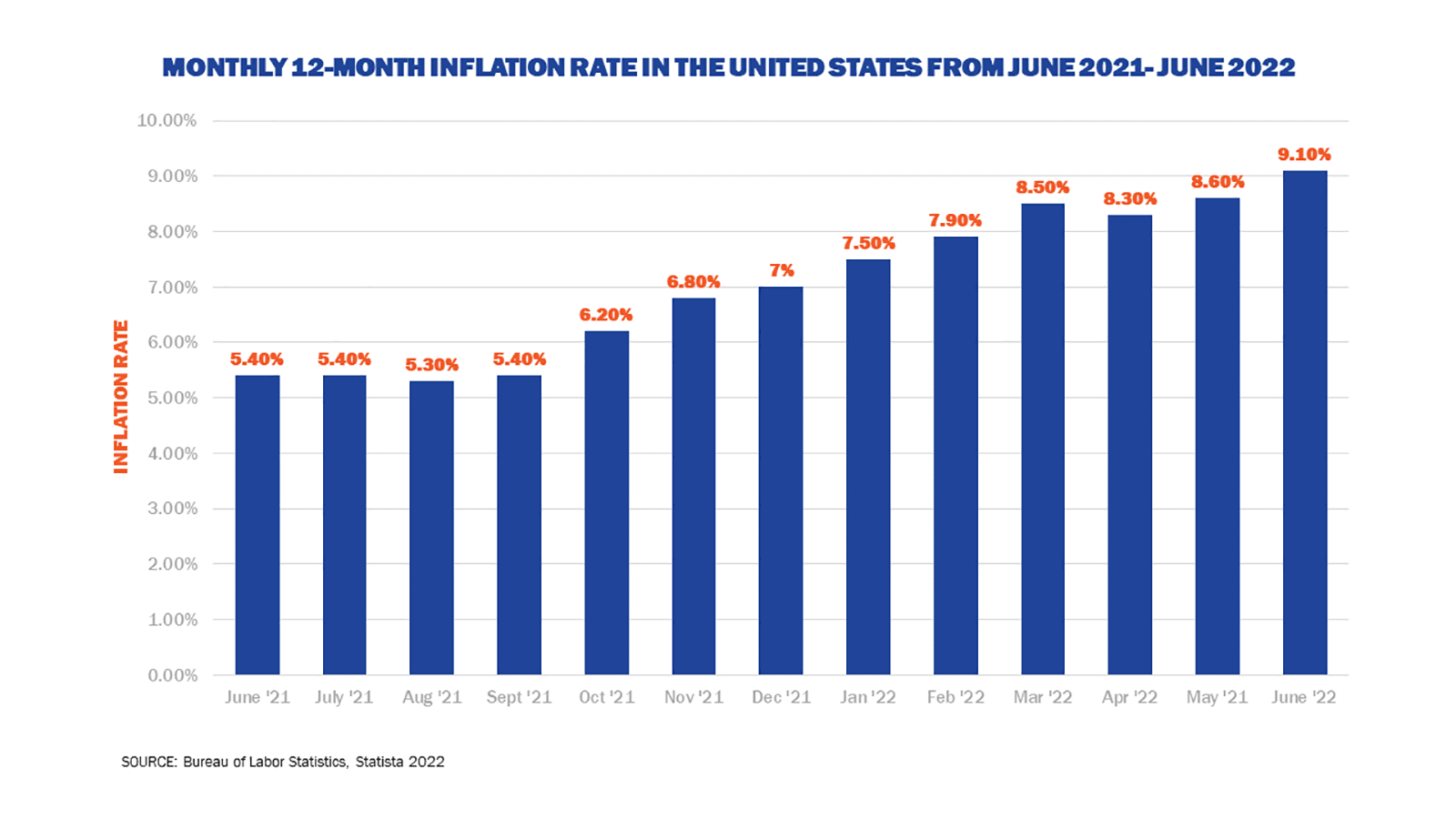

Resume Builder conducted a survey of 800 retirees and found that 1 in 5 of them would likely return to work, with about 70% of those saying they are unretiring to combat inflation. The Bureau of Labor Statistics has seen an estimated 1.5 million early retirees return to the workplace. According to the U.S. Labor Department, there is an “unretirement” trend happening. Those early retirement age workers, ages 55-64, are reaching pre-COVID-19 workplace participation numbers. Some of the reasons could be because of rising costs or a volatile stock market, but it also could be because of a robust job market.

According to the Resume Builder survey, many of these retirees returning to work are trying to compensate for the higher prices or combat inflation. Retirement Planners of America CEO and Sr. Advisor Ken Moraif explains, “There is no magic bullet that can make you afford higher prices of things. It’s just a matter of you having to cut unnecessary or discretionary expenses to compensate for the fact that the necessities are more expensive, or you can increase your income, or do both.”

The labor shortage or robust job market has made it possible for many to return to the workplace to possibly compensate for rising prices. Moraif says, “Because there is a huge labor shortage, it plays well for people to unretire and go back to work. You basically have to look at how you make up for the higher cost of living.”

If you are approaching retirement age and don’t want to feel like you have to go back to work once you’re retired to make ends meet, having a plan could be important. Moraif explains how at RPOA, “we use a Retirement Cash Flow Plan (RCFP). Our approach accounts for inflation. We take that into account in our planning in advance, so that when you have times like what we’re going through right now, you kind of accounted for that in advance.”

Something like the RCFP could help keep you in retirement because you planned for a rise in inflation. Moraif quotes Ben Franklin, who said, “If you fail to plan, you are planning to fail.” If you’d like to get a plan in place and learn more about RPOA’s RCFP, you can meet with one of our financial advisors for a free consultation today.